Introduction

Kenya’s real estate market is at a pivotal crossroads. With rapid urbanization, a growing middle class, and significant government initiatives aimed at bridging the housing deficit, the demand for housing has never been higher. Yet, amidst soaring land prices and luxury developments in prime areas like Nairobi’s Westlands or Mombasa’s Nyali, a quiet revolution is unfolding in the affordable housing segment. Increasingly, savvy investors are turning their attention to this underserved yet high-potential niche and for good reason.

1. Kenya’s Massive Housing Deficit Creates Strong Demand

Kenya currently faces a housing deficit estimated at over 2 million units, with the demand growing annually due to population growth, urban migration, and household fragmentation. According to the National Housing Corporation (NHC), over 60% of Kenyans live in informal settlements due to a lack of affordable housing options.

This gap represents a massive opportunity: affordable homes priced between Ksh 1 million and Ksh 5 million cater directly to a large demographic—including teachers, nurses, civil servants, young professionals, and first-time homeowners—who are creditworthy but often excluded from traditional mortgage markets. Investing in this segment means tapping into a consistent, high-demand market with minimal vacancy risk.

2. Government Support and Policy Tailwinds

The Kenyan government has placed affordable housing at the heart of its economic agenda. Key initiatives include:

- Affordable Housing Program (AHP): Launched under the Big Four Agenda, the program targets the construction of 500,000 affordable units by 2027.

- Tax incentives: Developers of affordable housing benefit from VAT exemptions, reduced stamp duty, and lower corporate tax rates.

- Public-private partnerships (PPPs): The government is encouraging collaboration with private developers to accelerate delivery, offering land and infrastructure support.

- Housing Fund: Though its implementation has faced challenges, the fund aims to mobilize contributions from workers to boost home ownership.

These policies significantly reduce development costs and de-risk investments, making affordable housing a more attractive proposition than ever before.

3. High Rental Yields and Quick Turnaround

Affordable homes typically yield higher rental returns compared to luxury properties. In Nairobi and its satellite towns like Ruiru, Kitengela, and Athi River:

- Rental yields on affordable units (1–2 bedrooms) often range from 8% to 12% annually, compared to 4–6% for high-end apartments.

- Tenants in this segment are often long-term renters, resulting in lower tenant turnover and more consistent cash flow.

- Faster project absorption: Affordable housing units sell or rent out quicker due to pent-up demand, improving capital recovery timelines and enabling reinvestment.

For example, a Ksh 3 million 2-bedroom unit in Syokimau rented at Ksh 18,000/month yields 7.2% annually before expenses and when managed well, net yields easily exceed 8%.

4. Lower Entry Barriers for Investors

Affordable housing projects require less upfront capital compared to luxury developments. Smaller unit sizes, standardized designs, and bulk construction methods reduce costs per unit, enabling:

- Smaller developers and individual investors to participate.

- Faster project approvals, as many affordable housing sites are located in designated Special Planning Areas or outside congested CBDs.

- Scalability: Investors can start with a few units and expand as cash flow permits.

Additionally, partnerships with SACCOs, microfinance institutions, and digital lenders now offer innovative financing solutions for both developers and end-buyers, further enhancing accessibility.

5. Long-Term Appreciation Potential

While luxury properties may plateau in value due to market saturation, affordable homes in emerging urban corridors are positioned for strong capital appreciation. Areas like Konza City, Tatu City, and Ruaka are experiencing rapid infrastructure development new roads, water systems, and commercial hubs that boost land and property values over time.

Investors who get in early in these growth nodes can benefit from 20–30% appreciation over 5–7 years, especially as improved infrastructure attracts more residents and businesses.

6. Social Impact Meets Financial Returns

Beyond the numbers, affordable housing investment aligns with Environmental, Social, and Governance (ESG) principles an increasingly important consideration for institutional investors and development finance institutions (DFIs). Projects that improve living standards, reduce slum density, and create local jobs often gain favor with:

- International donors (e.g., World Bank, UN-Habitat)

- Kenyan pension funds looking for stable, impactful assets

- Green building certifiers offering sustainability incentives

This dual benefit profit with purpose enhances brand value and opens doors to additional funding and partnerships.

7. Mitigating Risks Through Smart Planning

Like any investment, affordable housing isn’t without risks construction delays, title disputes, or poor location choices can undermine returns. However, these can be mitigated by:

- Conducting thorough due diligence on land titles and zoning laws.

- Partnering with experienced local developers or project managers.

- Prioritizing locations with existing or planned infrastructure (e.g., near BRT routes, new highways, or industrial parks).

- Using modular or prefabricated construction to control costs and timelines.

Conclusion: The Future Is Affordable

Kenya’s real estate market is evolving, and the era of “bigger, taller, and more expensive” is giving way to smarter, more inclusive development. Affordable housing isn’t just a response to a national crisis it’s a financially sound, scalable, and future-proof investment strategy.

For developers, institutional investors, and even individual buyers looking to build wealth through real estate, the affordable segment offers strong cash flow, policy support, high demand, and meaningful social impact. In a country where over 80% of households cannot afford market-rate homes, the smartest bet isn’t on penthouses it’s on pragmatic, well-located, quality homes that meet the needs of the many.

Now is the time to invest in Kenya’s affordable housing revolution not just because it’s needed, but because it pays.

Call to Action

Are you considering your next real estate investment in Kenya?

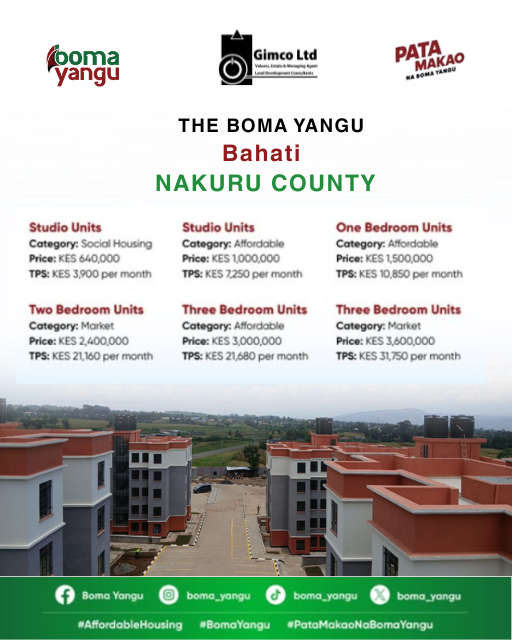

Don’t miss your chance to be part of Kenya’s housing transformation.

✅ Visit Boma Yangu to register and apply for affordable homes.

✅ Reach out to Gimco Limited via phone or email for expert assistance in navigating the process and securing your dream home.

Your future home and a smart investment awaits.